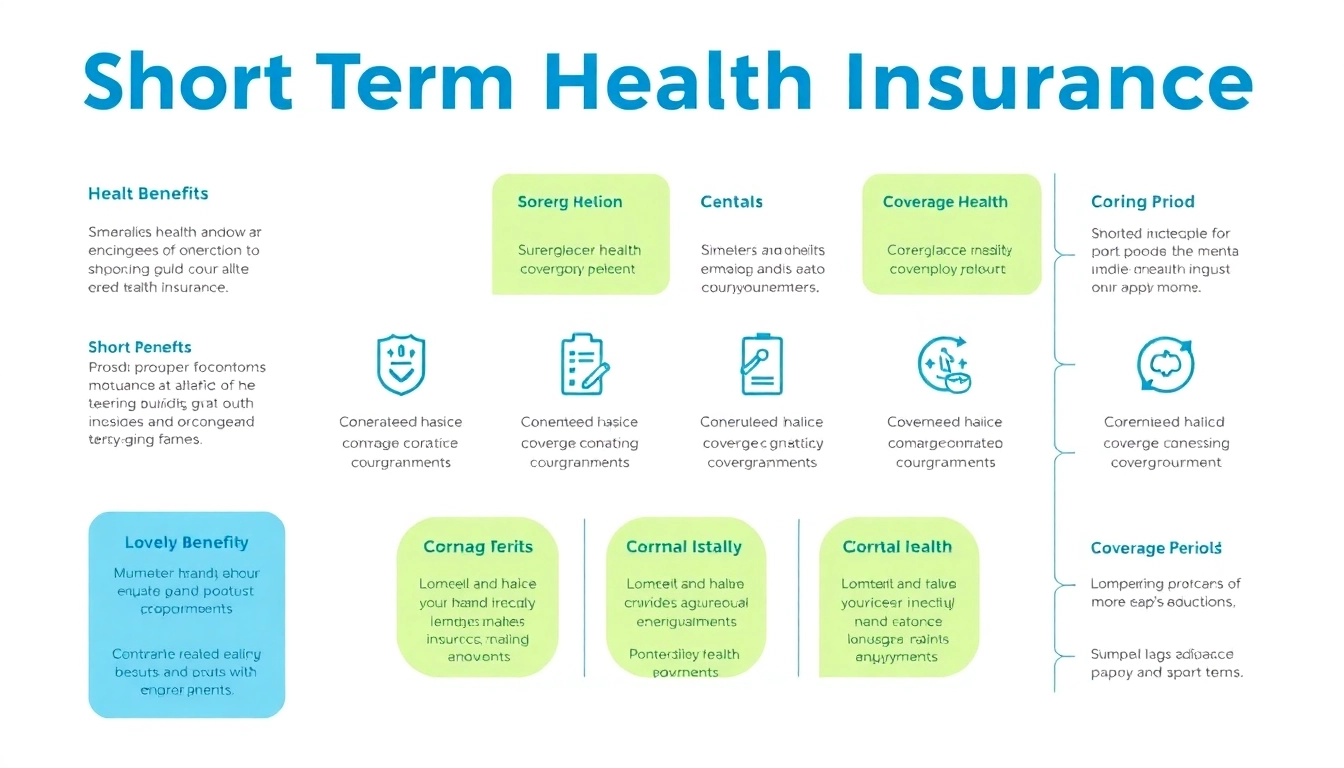

Understanding Short Term Health Insurance

Short term health insurance is a vital yet often misunderstood component of the insurance market. It provides temporary coverage designed to bridge gaps in healthcare for individuals who are between jobs, waiting for permanent insurance to take effect, or in need of short-term support due to various life circumstances. For a detailed exploration of this important topic, consider referring to this Short Term Health Insurance Explained article for specific insights and guidance.

What is Short Term Health Insurance?

Short term health insurance provides coverage for a limited duration, usually ranging from one month to a year, although specific regulations may adjust this period over time. These plans are not designed to be long-term solutions but serve as a safety net during transitional periods. Unlike traditional health insurance policies, short term plans are more flexible and can often be acquired quicker. However, they come with significant limitations in coverage which can be crucial for prospective buyers to understand.

Key Features of Short Term Health Insurance

- Temporary Coverage: As implied by the name, short term health insurance is intended to last for a shorter duration, typically from one to twelve months, depending on state regulations.

- Limited Benefits: These plans generally do not cover essential health benefits like preventive care, mental health services, or treatment for pre-existing conditions.

- Lower Premiums: Compared to traditional long-term insurance plans, short term health insurance usually offers lower monthly premiums, making it an attractive option for those needing immediate but temporary coverage.

- Fast Application Process: Many short term health insurance plans can be acquired quickly, often without the extensive application procedures involved in traditional plans.

Who Needs Short Term Health Insurance?

Short term health insurance is ideal for several demographics, including:

- Transitioning Employees: Those who are changing jobs and have a gap in coverage.

- Recent Graduates: Young adults who have just completed their studies and are searching for employment.

- Freelancers and Contractors: Individuals whose employment status is fluid and may lack consistent health coverage.

- Waiting for Medicare to Begin: Seniors awaiting Medicare eligibility but need interim coverage.

Comparing Short Term Health Insurance Plans

Costs and Coverage Options

The cost of short term health insurance can vary widely based on several factors, including geographical location, age, and specific healthcare needs. These plans tend to offer lower premiums than traditional plans, but it’s important to weigh costs against the coverage items that are excluded. For instance, many short term plans significantly limit or outright exclude coverage for:

- Pre-existing conditions

- Maternity care

- Preventive services

- Mental health treatment

As such, consumers must closely examine what services are included and consider their own health situations when selecting a plan.

Benefits and Limitations

Short term health insurance has its distinct advantages, including lower costs and faster access to coverage. However, it also carries limitations:

- Benefits:

- Immediate coverage options available.

- Lower premiums relative to long-term insurance.

- Flexible duration aligning with personal needs.

- Limitations:

- Exclusions for pre-existing conditions can leave many without necessary care.

- Limited benefits may not cover larger health issues or accidents.

- May not meet minimum essential coverage criteria under the Affordable Care Act (ACA).

How to Choose the Right Plan

Selecting the appropriate short term health insurance requires careful consideration of several factors:

- Health Status: Individuals with existing health conditions should verify how the plan accommodates or excludes their needs.

- Duration of Coverage Needed: Determine how long you require coverage to pick a plan that fits your timeline.

- Cost-Benefit Analysis: Evaluate whether the premium savings outweigh the potential out-of-pocket costs during a medical event.

- Provider Network: Research if preferred healthcare providers and facilities are within the plan’s network.

Navigating Eligibility and Enrollment

Who Qualifies for Short Term Plans?

Eligibility for short term health insurance plans can vary by state and provider, but general prerequisites include:

- Must be a resident of the state where you are applying.

- You generally cannot participate if you are eligible for or enrolled in Medicare.

- Some plans might require applicants to pass a brief health questionnaire.

How to Apply for Short Term Health Insurance

The application process for short term health insurance is often streamlined for efficiency. Here are the steps to apply:

- Gather Documentation: Collect necessary personal information, including identification and, if applicable, medical records.

- Online Application: Most providers have online portals for submitting applications quickly.

- Review Your Plan: After applying, review the policy details and ensure they meet your needs before confirming.

Duration and Renewal of Coverage

Most short term plans have specific terms dictating the length of coverage. Notably, regulations may limit coverage duration to three months in certain instances. Renewal options can differ, with some plans allowing you to extend your coverage for another term, while others may not support renewals and typically require you to apply for a new plan.

Common Misconceptions about Short Term Health Insurance

Debunking Myths: What You Should Know

There are several persistent myths surrounding short term health insurance that can mislead potential enrollees:

- Myth: It Covers Everything: Many assume that short term insurance functions like traditional health coverage; however, this is not accurate. It lacks comprehensive care and extensive networks.

- Myth: It’s Too Expensive: Compared to traditional plans, short term options can be less costly, though understanding hidden costs is crucial.

- Myth: Everyone Can Get It Anytime: While short term plans are generally more accessible, certain eligibility criteria must be met.

Comparing Short Term vs. Long Term Health Insurance

Understanding the differences between short term and long term health insurance is critical for consumers:

- Coverage Duration: Short term policies are for temporary needs, while long-term insurance is meant for continuous use.

- Cost: Short term health insurance generally has a lower upfront cost but may lead to greater expenses without coverage.

- Benefits: Long-term plans cover preventive services and pre-existing conditions, unlike short term plans which can have significant exclusions.

Understanding Coverage Gaps

Coverage gaps can occur due to transition periods when individuals shift jobs or circumstances change. Short term health insurance is designed to fill these gaps but recognizes limits in scope. Individuals must stay informed about what is covered versus what is not to avoid surprises when seeking care.

Making the Most of Your Short Term Health Insurance

Using your Insurance Effectively

To maximize the benefits of your short term health insurance:

- Stay In-Network: Always seek care from providers within the network to minimize out-of-pocket costs.

- Understand Your Plan: Familiarize yourself with the specific details of your plan to ensure you access covered services.

Filing Claims and Understanding Costs

Filing claims with short term health insurance may differ from traditional plans. To ensure timely payments, familiarize yourself with the claims process:

- Gather all related paperwork, including proof of your medical visit and any diagnostic tests.

- File claims as instructed by your provider’s guidelines to reduce the likelihood of complications in processing.

When to Transition to a Long-Term Plan

Eventually, relying solely on short term health insurance may no longer be practical. Consider transitioning to a long-term plan if:

- Your temporary employment turns into a long-term position.

- You develop chronic health conditions requiring consistent care.

- You reach the limit of your short-term coverage options and need a comprehensive safety net.